Insurance Appraiser

Alternative Dispute Resolution

Insurance Appraiser

As a form of alternative insurance dispute resolution (vs. filing a lawsuit), it can resolve the disagreement between you and your Insurance Carrier when you disagree on the scope of loss, amount, and causation depending on your state’s laws.

Who can be an Insurance Appraiser?

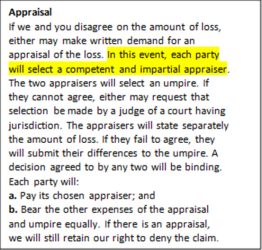

Let’s look at an example of an Appraisal Clause from a real policy:

**Note: Your policy may be different and the above is merely one example.

There are not many requirements to be an Insurance Appraiser in most states.

According to the sample Appraisal Clause seen above, the first requirement is your appraiser should be competent.

They should be knowledgeable about the subject matter of your appraisal. For example, you wouldn’t want to hire an accountant for your roofing claim appraisal as accountants are not experts in roofing–you’d want someone who is an expert in roofing.

The second requirement is the Appraisers should be impartial or disinterested.

They should represent the facts of the loss and not their perspective hiring parties. They should only charge

by the hour or by a flat fee in appraisal.

What Are the Duties of an Insurance Appraiser?

Firstly, the two named Appraisers have to select an Umpire. Once the appraisal panel is seated (both Appraisers and Umpire), your Appraiser and the Insurance Carrier’s Appraiser will inspect the loss, estimate the damage, and try to agree on the amount of loss. If the two Appraisers cannot agree, then either may invoke the Umpire. Once they have all reviewed the loss, both Appraisers submit their positions to the Umpire. The Umpire will issue an award somewhere between the two Appraisers’ positions. Once an itemized decision is agreed to by any two of the three appraisal panel members, it will set the amount of loss.

What Do Appraisers Charge?

The answer depends on whom you hire as your appraiser. Most Insurance Appraisers charge by the hour plus expenses (travel, experts such as an engineer if needed). Some charge a flat fee depending on the size of your loss. In most circumstances, they usually charge a minimum retainer amount. An Insurance Appraiser should NEVER charge a contingency fee as that would make them an interested party instead of an independent or disinterested party.

Do You Need an Appraiser?

Jonathan Kaiser of New Hope Claims is a P.L.A.N. and IAUA-certified Appraiser

and provides service in multiple states in the Midwest. Let him assist in your disputed claims.

The Property Loss Appraisal Network (P.L.A.N.)

was created upon the principles and desires to maintain truth, honesty, and integrity within our industry with an emphasis on the professional and ethical conduct and behavior of those who serve within.

Insurance Appraiser & Umpire Association (IAUA)

has been formed to established and maintain the highest level of professional standards and services for the

purposes of protecting the rights of the insured and

insurers in the Appraisal process.