Insurance Appraisal Process

Alternative Dispute Resolution

The Insurance Appraisal Process

Insurance Appraisal is a form of alternate dispute resolution for Property Insurance Claims.

Insurance Appraisal is intended to be a cost-effective and quicker way to resolve disputes with your Insurance Company.

How does the Insurance Appraisal Process work?

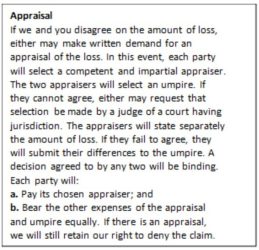

Let’s look at an example of an Insurance Appraisal clause from a real policy:

**Note: Your policy may be different and the above is merely one example.

- The first part of the example Insurance Appraisal Clause shows that a disagreement must be established by If we and you disagree… Once a disagreement has been established, either party may make a written demand for an appraisal of the

- When either party makes a written demand for appraisal, both parties are to select a competent and impartial appraiser.

They should be knowledgeable about the subject matter of your appraisal. For example, you wouldn’t want to hire an accountant for your roofing claim appraisal as accountants are not experts in roofing– you’d want someone who is an expert in roofing.

They should objectively represent the facts of the loss and not the interests of their perspective hiring parties. They should only charge by the hour or by a flat fee in appraisal.

It is a common requirement for both parties to name their appraiser within 20 days of the demand.

- Once both party’s appraisers have been named, they are to select an Umpire typically within 15 days. If the appraisers cannot agree on an Umpire, either party may approach the local court to have an Umpire appointed by the court.

- Once the appraisal panel is seated (both Appraisers and Umpire), your Appraiser and the Insurance Carrier’s Appraiser, in most circumstances, will inspect your loss, estimate the damage, and try to agree on the scope and amount of loss

If the Appraisers agree on the amount of loss, they will sign an award on the appraisal and issue a copy of the award and estimate to the parties.

- If the Appraisers disagree… then either may invoke the Umpire. Once all parties have reviewed the loss, both Appraisers submit their positions to the Umpire. The Umpire should issue an award no lower than the lowest position and no higher than the highest position. Once an itemized decision is agreed upon by any two of the three appraisal panel members, they will sign an award on the appraisal and issue a copy of the award and estimate to the parties.

Who Pays for an Insurance Appraisal?

Each party (you and your Insurance Carrier) is responsible to pay their own individual Appraiser.

Other expenses of the appraisal (ie., Umpire fees and other experts such as Engineers, Meteorologist, etc.) are to be split equally between both principal parties.

What Does It Cost?

Appraisers must charge either an hourly fee or a flat fee in order to maintain a disinterested

involvement. The exact cost is unknown and dependent on:

- how agreeable the other Appraiser will be.

- if other experts are needed.

- if the services of an Umpire are required.

Do You Need an Appraiser or Umpire?

Jonathan Kaiser of New Hope Claims is a P.L.A.N. and IAUA-certified Appraiser & Umpire

and provides service in multiple states in the Midwest. Let him assist in your disputed claims.

NOTICE: You should never demand Insurance Appraisal without being in full compliance with your Duties After Loss and officially

retaining an Appraiser. You should never name anyone as your Appraiser without them agreeing to perform your appraisal and

having officially retained them by signing their retainer agreement and paying their retainer.

The Property Loss Appraisal Network (P.L.A.N.)

was created upon the principles and desires to maintain truth, honesty, and integrity within our industry with an emphasis on the professional and ethical conduct and behavior of those who serve within.

Insurance Appraiser & Umpire Association (IAUA)

has been formed to established and maintain the highest level of professional standards and services for the

purposes of protecting the rights of the insured and

insurers in the Appraisal process.