Insurance Umpire

Alternative Dispute Resolution

Appointed by the Appraisers

Insurance Umpire

As discussed on the Insurance Appraisal and the Insurance Appraisal Process pages, Appraisal is a form of alternate

dispute resolution for Property Insurance Claims built into most residential and commercial insurance policies.

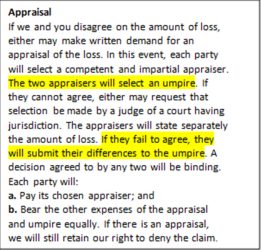

Let’s look at an example of an Appraisal Clause from a real policy:

**Note: Your policy may be different and the above is merely one example.

What is an Insurance Umpire?

An Insurance Umpire is an individual similar to a judge in a court proceeding. They are charged with settling any disputed items in the appraisal when and if the two Appraisers fail to reach an agreement.

Who Selects the Insurance Umpire?

After the appraisal has been demanded and both parties hire their own Appraiser, the Appraisers must then select an Umpire. Typically, both Appraisers will submit a list of prospective Umpires to each other and try to agree on one. If they can’t agree on an Insurance Umpire then either side may petition a court of local jurisdiction to make the selection for the primary parties.

What Are the Duties of an Insurance Umpire?

When invoked, the Umpire should tour and inspect the loss with both Appraisers at the same time in most

circumstances. Once they have all reviewed the loss, both Appraisers should submit their positions to the

Umpire. The Umpire should review and research all the facts and evidence presented to them by both

Appraisers and issue an award no lower than the lowest position and no higher than the highest position. If

neither Appraiser agrees, they will hear further evidence from both Appraisers and issue a new award. Once

an itemized decision is agreed to by any two of the three appraisal panel members it will set the amount of loss.

What Does an Insurance Umpire Cost?

The answer depends on whom is selected as your Umpire. Most Insurance Umpires charge by the hour plus

expenses (travel). Some charge a flat fee depending on the size of your loss. In most circumstances, they

usually charge a minimum retainer amount. An Umpire should NEVER charge a percentage or contingency fee

as that would make them an interested party instead of an independent or disinterested party.

Who Pays for The Umpire?

The umpire’s fees are to be split equally between you and your Insurance Carrier.

Many times, their fee must be paid before an award will be issued.

Do You Need an Umpire?

Jonathan Kaiser of New Hope Claims is a P.L.A.N. and IAUA-certified Umpire

and provides service in multiple states in the Midwest. Let him assist in your disputed claims.

If you need an Umpire for an appraisal, request Jonathan’s CV.

The Property Loss Appraisal Network (P.L.A.N.)

was created upon the principles and desires to maintain truth, honesty, and integrity within our industry with an emphasis on the professional and ethical conduct and behavior of those who serve within.

Insurance Appraiser & Umpire Association (IAUA)

has been formed to established and maintain the highest level of professional standards and services for the

purposes of protecting the rights of the insured and

insurers in the Appraisal process.